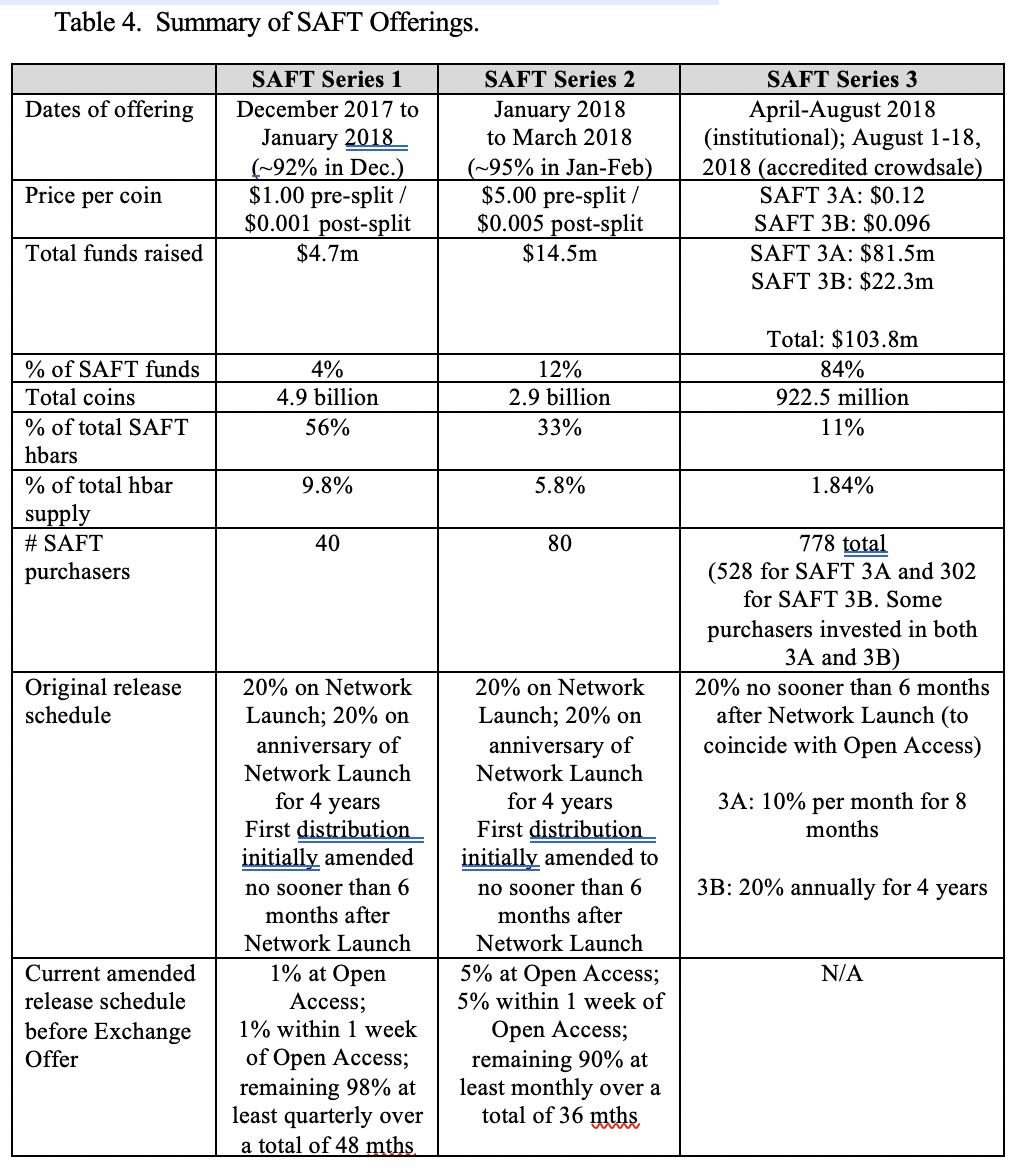

Hedera raised capital to develop the Hedera network through the issuance of Simple Agreements for Future Tokens (“SAFTs”). Hedera offered three series of SAFTs, each with different terms as set forth below. Due to increased investor interest and market comparables prior to the third series, the first two series of SAFTs were amended on March 30, 2018 to effect a 1:1000 coin-split, changing the total coin supply that would be minted from 50 million to 50 billion coins and significantly lowering the effective price per coin for SAFT purchasers (“Amendment No. 1”). Amendment No. 1 also changed the original distributions terms. The descriptions below provide both the original and the split-adjusted coin price and the original and amended distribution terms for SAFT Series 1 and SAFT Series 2.

- SAFT Series 1: SAFT Series 1 was offered to employees, other early contributors and advisors, friends, and family in an offering exempt from registration under the Securities Act of 1933 (the “Securities Act”). Under SAFT Series 1, Hedera raised $4.7 million from 40 purchasers. The original price per coin was $1.00, based on an original total supply of 50 million coins. After Amendment No. 1, the adjusted purchase price was $0.001 per coin. Hedera sold 4.9 billion coins (split-adjusted) through SAFT Series 1, which represents 56% of all coins sold via SAFTs and 9.8% of the total coin supply. The SAFT Series 1 offering commenced in December 2017 and final investment forms were received by January 2018.

The original terms for coin release provided that 20% of the coins would be released upon Network Launch, and 20% on each of the subsequent four anniversaries of Network Launch. Amendment No. 1 changed the distribution schedule to provide that the initial 20% would not be released until at least six months after Network Launch. Following two additional amendments approved by the holders of SAFT Series 1 in August 2019 and October 2019, coins from SAFT Series 1 are being released to purchasers on a more gradual basis to better align with expected network growth: 2% were released to SAFT Series 1 purchasers on the date of Open Access, 2% were released in the seven days following Open Access, and the remainder of the coins are being released at least quarterly, over a period that ends in September 2023.

- SAFT Series 1N: If the SAFT Series 1 holder accepted the tender offer to convert their Series 1 SAFT to Series 1N SAFT, the extended schedule for the original allocation (measured from Open Access on September 16th, 2019) is 1 week + 60 months. The SAFT Series 1N holder will receive the remaining 85.75% of their original hbar allocation over the remaining 54 months of the extended schedule. In addition, the SAFT Series 1N holder will receive additional hbars distributed over an unknown period until the cumulative value of those additional distributions equals your original Series 1 SAFT purchase amount (in USD).

- SAFT Series 1N: If the SAFT Series 1 holder accepted the tender offer to convert their Series 1 SAFT to Series 1N SAFT, the extended schedule for the original allocation (measured from Open Access on September 16th, 2019) is 1 week + 60 months. The SAFT Series 1N holder will receive the remaining 85.75% of their original hbar allocation over the remaining 54 months of the extended schedule. In addition, the SAFT Series 1N holder will receive additional hbars distributed over an unknown period until the cumulative value of those additional distributions equals your original Series 1 SAFT purchase amount (in USD).

- SAFT Series 2: SAFT Series 2 was offered to employees and contractors, friends and family, and strategic partners, advisors and investment funds in an offering exempt from registration under the Securities Act. Under SAFT Series 2, Hedera raised $14.5 million from 80 purchasers. The original price per coin was $5.00, and the split-adjusted price following Amendment No. 1 was $0.005 per coin. 2.9 billion coins (split-adjusted) were sold through SAFT Series 2, which represents 33% of all coins sold via SAFTs and 5.8% of the total coin supply. The SAFT Series 2 offering commenced in January 2018. Approximately 95% of SAFT Series 2 purchases occurred in January and February 2018, with some final investment forms received through mid-March 2018.

As with SAFT Series 1, described above, the original terms for coin release for SAFT Series 2 provided that 20% of the coins would be released upon Network Launch, and 20% on each of the subsequent four anniversaries of Network Launch. Amendment No. 1 changed the distribution schedule to provide that the initial 20% would not be released until at least six months after Network Launch. Following an additional amendment approved by the holders of SAFT Series 2 in August 2019, coins from SAFT Series 2 are being released to purchasers on a more gradual basis to better align with expected network growth: 5% were released to SAFT Series 2 purchasers on the date of Open Access, 5% were released in the seven days following Open Access, and the remainder of the coins are being released at least monthly, over a period that ends in September 2022.

- SAFT Series 2N: If the SAFT Series 2 holder accepted the tender offer to convert their Series 2 SAFT to Series 2N SAFT, the extended schedule for the original allocation (measured from Open Access on September 16th, 2019) is 1 week + 45 months. The SAFT Series 2N holder will receive the remaining 75% of their original hbar allocation over the remaining 39 months of the extended schedule. In addition, the SAFT Series 2N holder will receive additional hbars distributed over an unknown period until the cumulative value of those additional distributions equals your original Series 2 SAFT purchase amount (in USD).

- SAFT Series 2N: If the SAFT Series 2 holder accepted the tender offer to convert their Series 2 SAFT to Series 2N SAFT, the extended schedule for the original allocation (measured from Open Access on September 16th, 2019) is 1 week + 45 months. The SAFT Series 2N holder will receive the remaining 75% of their original hbar allocation over the remaining 39 months of the extended schedule. In addition, the SAFT Series 2N holder will receive additional hbars distributed over an unknown period until the cumulative value of those additional distributions equals your original Series 2 SAFT purchase amount (in USD).

- SAFT Series 3. SAFT Series 3 was offered to institutional investors and accredited investors in an offering exempt from registration under the Securities Act. It was completed in two phases. The first phase, which commenced in mid-April 2018, targeted institutional investors. The second phase, the “Accredited Crowdsale,” ran from August 1-18, 2018 and was open to accredited investors on the same terms offered to investors in the institutional investor phase (but with a lower minimum investment threshold). Under SAFT Series 3, Hedera raised approximately $103.8 million ($83 million during the institutional phase, and $20 million during the Accredited Crowdsale) from 778 total purchasers. SAFT Series 3 resulted in 922 million coins sold, which represents 11% of all coins sold via SAFTs and approximately 1.9% of the total coin supply. SAFT Series 3 offered two options to purchasers:

- SAFT Series 3A: $0.12 per coin (based on a total supply of 50 billion coins) with an 8-month release schedule (monthly distributions), with 20% of coins to be released no sooner than 6 months after Network Launch followed by 10% of coins released monthly over the following 8 months. A total of 528 purchasers chose SAFT Series 3A, investing a total amount of $81.5 million for 680 million coins. The first release of coins under SAFT Series 3A occurred at Open Access on September 16, 2019, and monthly distributions have occurred as planned and will continue to occur through May 16, 2020.

- SAFT Series 3AN: If the SAFT Series 3A holder accepted the tender offer to convert their Series 3A SAFT to Series 3AN SAFT, the extended schedule for the original allocation (measured from Open Access on September 16th, 2019) is 10 months. The SAFT Series 3AN holder will receive the remaining 20% of their original hbar allocation over the remaining 4 months of the extended schedule. In addition, the SAFT Series 3AN holder will receive additional hbars distributed over an unknown period until the cumulative value of those additional distributions equals your original Series 3A SAFT purchase amount (in USD).

- SAFT Series 3AN: If the SAFT Series 3A holder accepted the tender offer to convert their Series 3A SAFT to Series 3AN SAFT, the extended schedule for the original allocation (measured from Open Access on September 16th, 2019) is 10 months. The SAFT Series 3AN holder will receive the remaining 20% of their original hbar allocation over the remaining 4 months of the extended schedule. In addition, the SAFT Series 3AN holder will receive additional hbars distributed over an unknown period until the cumulative value of those additional distributions equals your original Series 3A SAFT purchase amount (in USD).

- SAFT Series 3B: $0.096 per coin (based on a total supply of 50 billion coins) with a 4-year release schedule (annual distributions) with 20% of coins to be released no sooner than 6 months after Network Launch followed by 20% of coins released annually over the following four years. A total of 302 purchasers chose SAFT Series 3B, investing a total amount of $22.3 million for 242 million coins. The first release of coins under SAFT Series 3B occurred at Open Access on September 16, 2019, and subsequent releases will occur on September 16 each year from 2020-2023.

- SAFT Series 3BN: If the SAFT Series 3B holder accepted the tender offer to convert their Series 3B SAFT to Series 3BN SAFT, the extended schedule for the original allocation (measured from Open Access on September 16th, 2019) is 5 years. The SAFT Series 3BN holder will receive the remaining 80% of their original hbar allocation on the next 5 anniversaries of Open Access (September 16). In addition, the SAFT Series 3BN holder will receive additional hbars distributed over an unknown period until the cumulative value of those additional distributions equals your original Series 3B SAFT purchase amount (in USD).

- SAFT Series 3A: $0.12 per coin (based on a total supply of 50 billion coins) with an 8-month release schedule (monthly distributions), with 20% of coins to be released no sooner than 6 months after Network Launch followed by 10% of coins released monthly over the following 8 months. A total of 528 purchasers chose SAFT Series 3A, investing a total amount of $81.5 million for 680 million coins. The first release of coins under SAFT Series 3A occurred at Open Access on September 16, 2019, and monthly distributions have occurred as planned and will continue to occur through May 16, 2020.

Some SAFT purchasers invested into more than one SAFT, including some holders of SAFT Series 1 and SAFT Series 2 who also invested additional funds in SAFT Series 3, and purchasers who invested in both SAFT Series 3A and SAFT Series 3B.

Hedera management and almost two-thirds of employees invested a total of more than $10 million in SAFT Series 3. Specifically, 28 employees invested a total of $10.48 million. One purchaser made a $10 million investment; the other 27 (some of whom also had invested in SAFT Series 1) invested an aggregate of $480,000 in SAFT Series 3.